The neobank wave is beginning to take shape in Africa, particularly in Nigeria, where new fintechs are trying to take on legacy banks by providing cheaper and more personalized banking services.

Sparkle, founded by an ex-CEO of a former Nigerian incumbent bank, is one such fintech, and it has closed a seed round of $3.1 million to scale operations.

Nigerians have a love-hate relationship with traditional banks. Even though the number of active bank accounts in the country is above 100 million (from a population of about 200 million), problems around inefficient service delivery, serial downtimes, and bad loans and experiences have made many people distrust banking services.

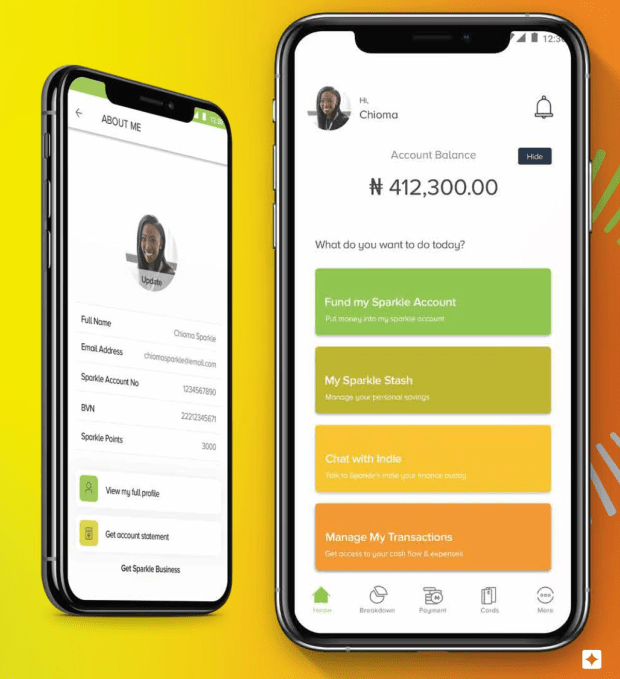

Neobanks sensed an opportunity and are vying for the attention of these banked but unsatisfied customers. Sparkle, like any neobank in the market, is counting on standard features such savings, bill payments, top-ups, requesting or sending funds, as well as less common features — like bill splitting and reviewing spending breakdowns — to attract customers in a crowded market.

“We’re quite different in a way because instead of separating financial services from lifestyle, we’ve tried to bring them together, especially as we’ve seen that more people are beginning to lead more digitally-led lives,” CEO Uzoma Dozie said to TechCrunch in an interview.

“It means that we don’t see our customers from accounts, payments, deposits or credit perspectives, but from how can we help them do what they want to do at any particular time.” So that’s Sparkle’s pitch — to provide financial, lifestyle and business support services to Nigerians.

In April, the company launched Sparkle Business to acquire a different set of underserved users: small and medium businesses. Sparkle claims the new business arm has caught on well with this category, which now has access to inventory and invoice management, tax advice, and payroll and employee management services.

These businesses can access these features with a tax identification number (TIN) and an email address — the lowest form of documentation in the market for businesses.

Image Credits: Sparkle

Sparkle’s mix of providing banking services to individuals and businesses on a single platform is unique. Other neobanks in the country — such as Kuda, VBank, FairMoney and Carbon — are known to offer tailored services to individuals. At the same time, platforms including Brass and Prospa cater to varying sizes of businesses.

“As a small business, I’m not carrying my bank account on my mobile. I’m carrying my business. So we are bringing everything about your business into one place so that you can do business wherever you are,” Dozie said. “For individuals, we’re bringing everything into one place so that you can do what you want to do quite easily wherever you are. But the bottom line is that we’re providing you with the information that you need to take spontaneous decisions.”

Dozie highlights some features of Sparkle that customers might hardly get with other platforms. For instance, customers can check the transaction history with a particular beneficiary without browsing through a financial statement, confirm the location where they made each transaction, and schedule payments.

Sparkle’s design is also tailored to how most Nigerians operate their lives offline. Customers can have multiple accounts (personal and business) and switch whenever they want to on Sparkle. They can use the platform on various phones with the same enhanced security as other platforms that allow login on a single phone, Dozie said.

Since launching last year, the neobank has acquired over 40,000 customers on the individual banking side and 2,000 businesses. The company began charging individual customers small fees to keep their accounts running and plans to charge businesses for most features except taxation services, said Dozie.

Similar to most digital banks in the country, Sparkle has a microfinance bank license. It has also secured a partnership with Visa to allow users to make in-person or digital payments with a Visa card. Other partnerships are with companies like Network International and PwC Nigeria.

Anyone knowledgeable on how the Nigerian fintech space works knows it can take some time to secure licenses and partnerships. Sparkle has been able to do so in under a year due to its CEO’s vast experience and connections.

Before Sparkle, Dozie was the CEO and last group managing director of Diamond Bank. He oversaw the bank’s corporate, commercial and retail arms before its merger with Access Bank; the business is now 29 million customers strong.

With Sparkle, Dozie is keen on expanding the capabilities of Nigeria’s banking and retail sectors, continuing from where he left off at Diamond Bank. As an investor himself, he enlisted an all-Nigerian cast for his seed round — lead investor Leadway Assurance, participant Trium Network and a few unnamed high-net-worth individuals. The investment comes after Sparkle closed a friends and family pre-seed round of $2 million within the past year.

He opined that while he could have raised money from foreign investors, he chose to go with this group of investors because they provide the experience and market that Sparkle needs to scale in Nigeria. He was also keen on getting high-net-worth individuals to invest in a tech company.

“Collectively, as a group of investors and business builders, we are Nigerians who are bullish about Nigeria and the opportunity the country presents in terms of building global networks and communities, all via one app,” the CEO said in a statement.

The CEO told TechCrunch that Sparkle will use the investment for two purposes: building robotic process automation to help with mundane and repetitive processes, then hiring talent across engineering, finance risk and marketing.

from TechCrunch https://ift.tt/2YLsLco

via Tech Geeky Hub

No comments:

Post a Comment