Fibery is a really interesting startup that’s aiming to be the single source of truth and work for product companies. The Cyprus-based company raised a $5.2 million series A recently, and I wanted to take a closer look at what makes the startup tick.

We’re always looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

Fibery raised its round with a 15-slide deck and shared the whole thing with TechCrunch unedited. That’ll give us a good idea of how the company landed its $5.2 million investment.

These are the slides:

- Cover slide

- Problem slide

- Solution slide

- Market size slide

- Competitor slide

- Competitive analysis slide

- Product slide

- “Building blocks” slide

- Feedback / customer validation slide

- Go-to market strategy slide

- Business model slide

- Traction slide

- Milestones to date slide

- Team slide

- The Ask slide

Four things to love

Click through the full deck, and you’re treated to a lot of white space, simplicity and clarity. The company made a few unusual design choices, which really work for me, and the story hangs together well. But there are a few things that I particularly enjoyed.

A solid competitive analysis

The company has two competition slides:

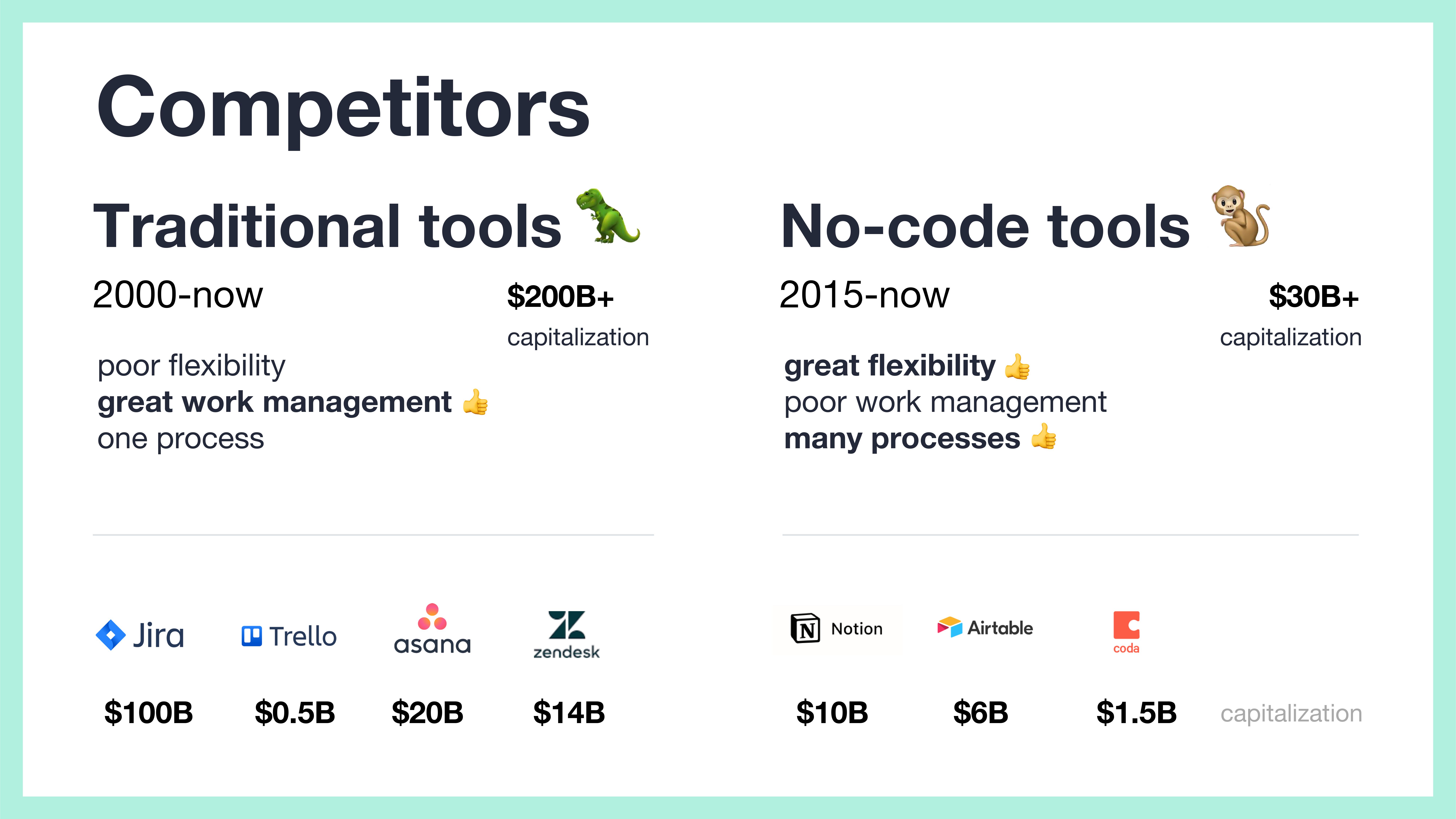

[Slide 5] Competition, part 1. Image Credits: Fibery.

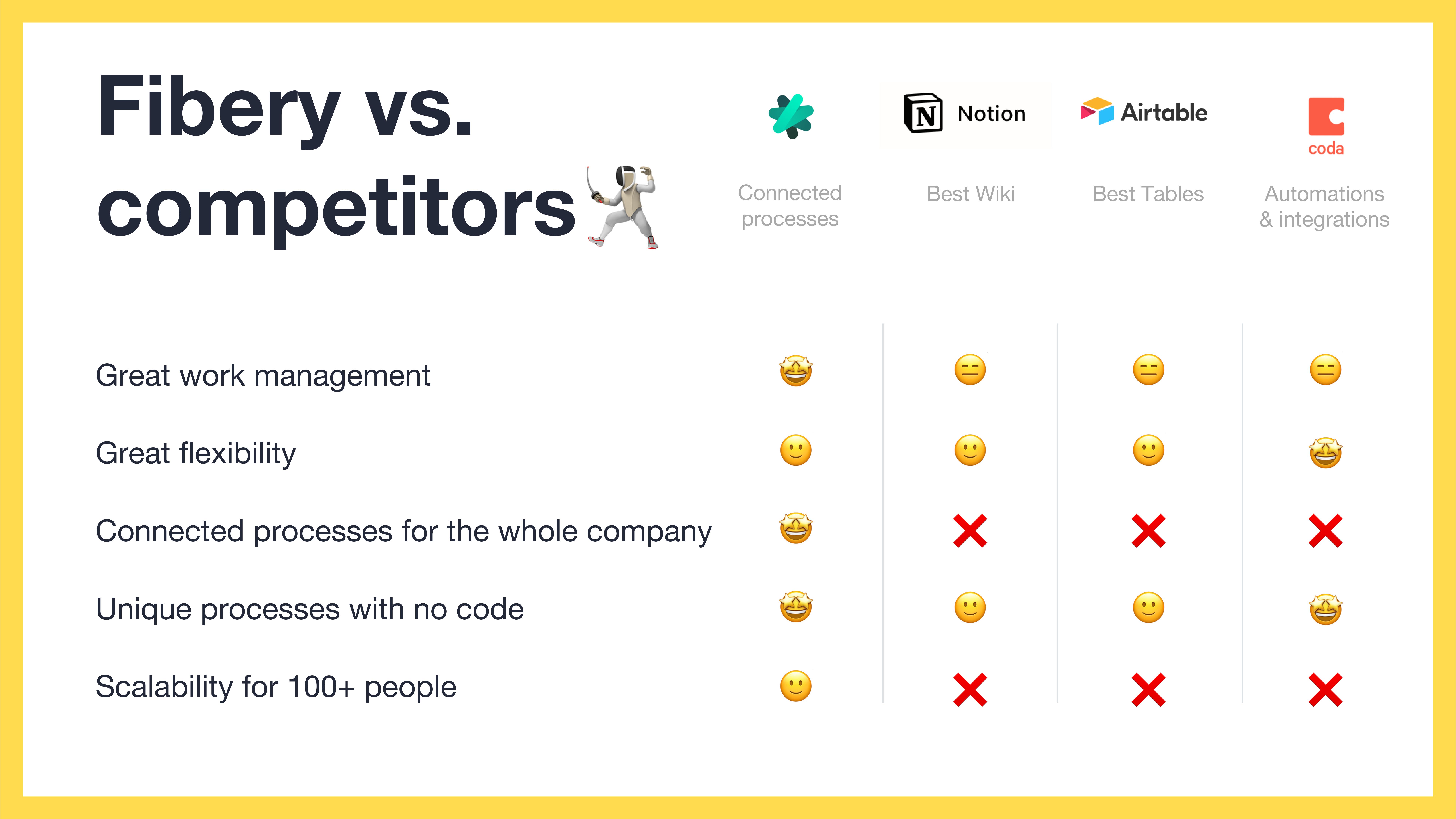

[Slide 6] Competition, part 2. Image Credits: Fibery.

On Slide 5, the company breaks down both the existing players in this space in a really elegant way, and shows that there’s a big market worth going after. It even manages to identify some of the strengths in its competitors, which is always a nice touch — especially if the solution does something slightly different or is able to offer an additional set of features or an approach to the problem that unlocks a broader or different customer base. Investor who might be interested in this space will know Jira, Trello, Asana and Zendesk; Fibery is shrewdly positioning itself opposite a few multibillion dollar companies. Smooth.

On Slide 6, there’s a slightly deeper dive into the other no-code tools Fibery considers to be competitors. Again, the company is choosing to praise its competitors for their strengths (“Best Tables” for Airtable, and “Best Wiki” for Notion).

This helps give a deeper understanding of what the company perceives is its positioning in the market.

Great business model clarity.

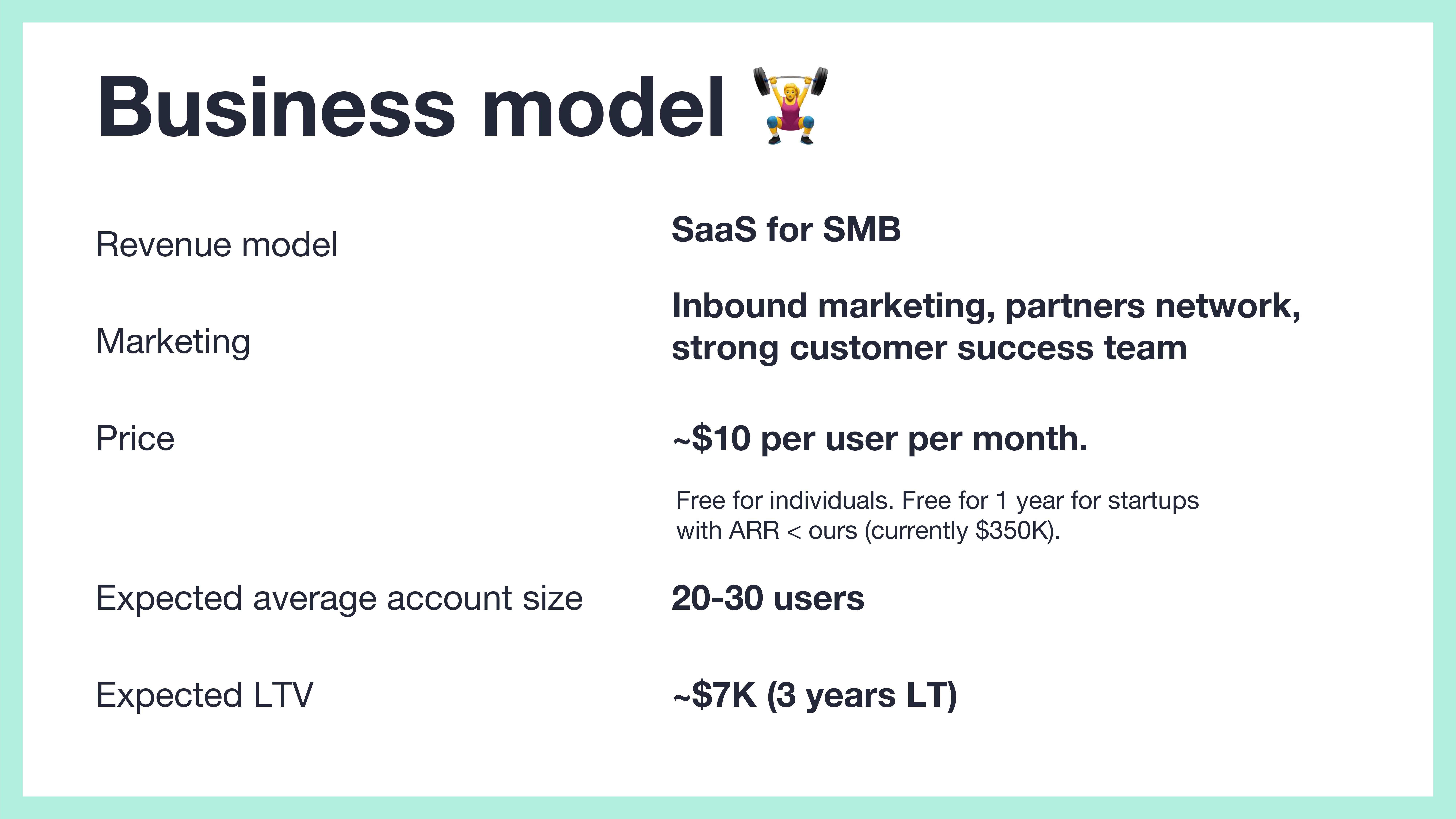

[Slide 11] Business model. Image Credits: Fibery.

Inbound marketing and customer success are both great when the customers are coming to you, and “partners network” is a little fuzzy. But it’s missing the customer acquisition cost. I’ll say a bit more about this below when I talk about things that could be improved but overall it’s a solid slide.

Metrics!

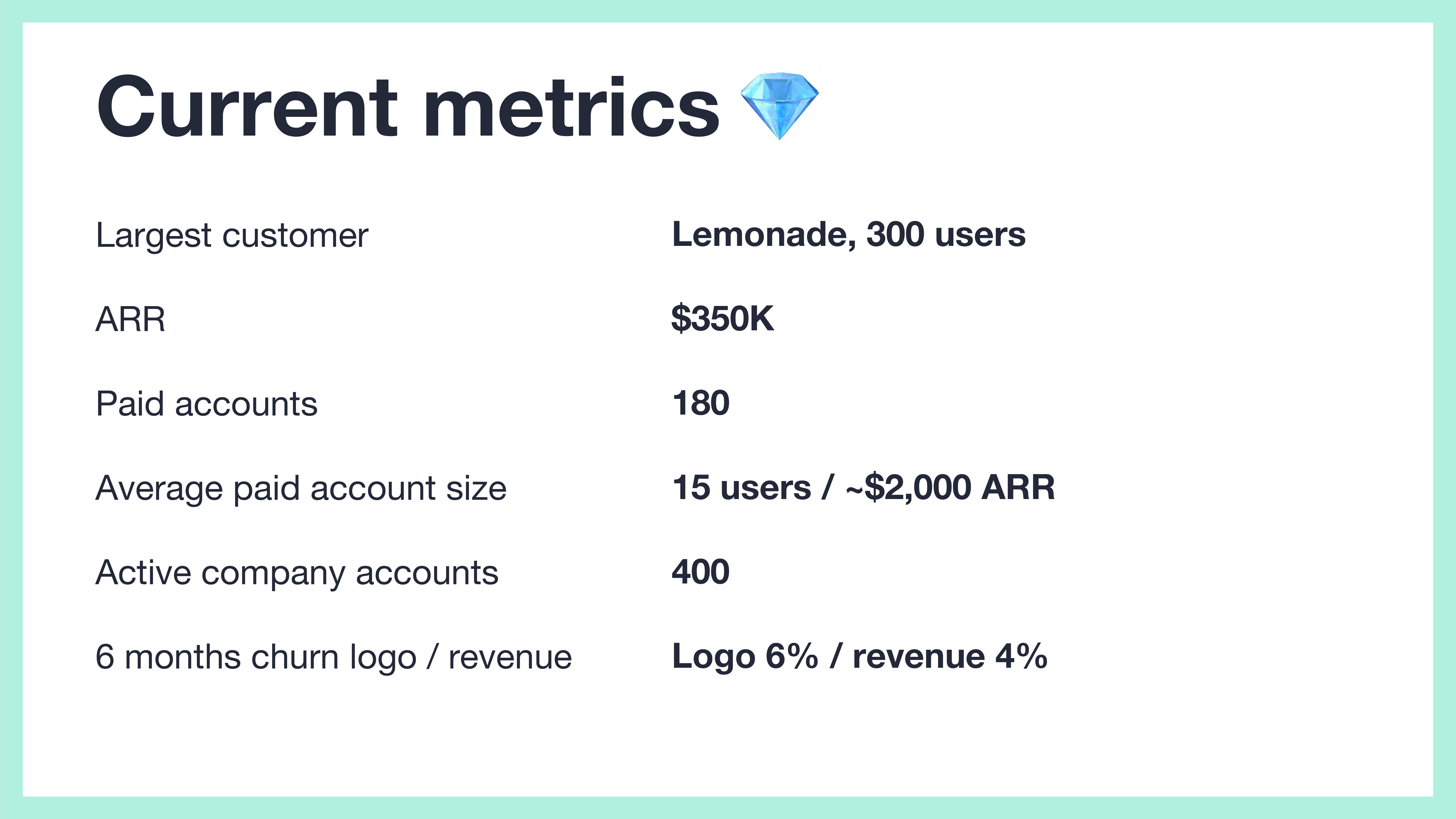

[Slide 12] Show me that traction. Image Credits: Fibery.

Still, I wish Fibery had shown some of these metrics as graphs. Having $350,000 annual recurring revenue is impressive, but if it had been stagnant for the past six months, that’d ring some warning bells. Investors don’t invest in snapshots, but in trends, so you may as well show them.

The other quirk is that the numbers are inconsistent. On Slide 11, it says that the expected average account size is 20-30, but on this snapshot slide, it shows that Fibery currently has 15 paid users per account. Not saying anything about how it expects to grow that number makes me suspicious.

Bonus win: Great ask slide

[Slide 15] Yessssss. Image Credits: Fibery.

In the rest of this teardown, I’ll take a look at three things Fibery could have improved or done differently, along with its full pitch deck!

Pitch Deck Teardown: Fibery’s $5.2M Series A deck by Haje Jan Kamps originally published on TechCrunch

from TechCrunch https://ift.tt/xmLMq45

via Tech Geeky Hub

No comments:

Post a Comment