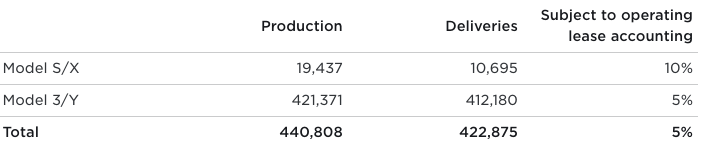

Tesla said Sunday it delivered 422,875 electric vehicles in the first quarter of 2023, just beating Wall Street estimates of around 420,000 units. The company produced 440,808 vehicles in the same period.

The delivery and production numbers are record results for the EV maker. In the fourth quarter of 2022, Tesla delivered 405,278 and produced 439,701 units. Those Q4 deliveries were also record results, but they missed Wall Street expectations.

It appears that a large percentage of deliveries came from vehicles produced by Tesla’s Shanghai gigafactory. The automaker has been issuing price cuts in all markets, including China, where the most recent discounts have caused a price war among competitors. The result is an increase of Tesla sales in China from last year, which suggests the East Asian country is helping to boost Tesla’s global delivery numbers.

Tesla doesn’t break down its delivery and production numbers by region, but according to data from the China Passenger Car Association (CPCA), Tesla collectively sold 140,453 China-made vehicles in January and February. The CPCA hasn’t yet published March’s data. If Tesla’s March deliveries in China match February’s numbers, it would mean more than 50% (or nearly 215,000) of Q1 deliveries came from Shanghai.

Tesla’s Q1 2023 delivery and production numbers. Image Credit: Tesla, via screenshot

Tesla started cutting prices for its EVs in China in October. Most recently, Tesla again reduced the prices of Model 3 and Y there in January by between 6% and 13.5%, adding fuel to the fire of a price war in the country. Rivals Xpeng and Nio, as well as international brands like Volkswagen and Mercedes-Benz, also discounted their prices to compete with Tesla cars, which are now up to 14% cheaper than last year. In some cases, they’re almost 50% less expensive than in the U.S. and Europe.

The automaker mirrored similar price cuts in Europe, Mexico and the U.S. over the past few months. This year, Tesla dropped prices for Model Y and Model 3 vehicles in the U.S. by up to 20%, and Model X and Model S vehicles by up to 9%. Last week, Tesla also relaunched its European referral program to try to increase sales before the end of the quarter.

Tesla’s share price rose 6.24% Sunday (in off trading hours) following the automaker’s quarterly production and delivery results.

Tesla needed a strong result after a volatile last few months in trading. At the end of 2022, Tesla’s share price plummeted amid CEO Elon Musk’s overhaul of Twitter. Investors were also concerned last year that the many discounts Tesla implemented across markets — including a $7,500 discount for U.S. buyers who took delivery before year’s end — might indicate low demand from customers.

During Tesla’s Q4 2022 earnings call in January, Musk tried to assuage investors by saying that demand actually exceeded production. At the time, Tesla acknowledged that the price decreases and general inflationary environment might affect the company’s short-term automotive margins, but that the company said it’s more focused on its operating margin.

We’ll know more about how the price decreases globally have affected the overall business when Tesla reports first quarter earnings on Wednesday, April 19. At the end of last year, Tesla said it expects to remain ahead of the long-term 50% compound annual growth rate with around 1.8 million cars for the year.

Tesla Q1 deliveries beat expectations as China helps boost sales by Rebecca Bellan originally published on TechCrunch

from TechCrunch https://ift.tt/4BreKXq

via Tech Geeky Hub

No comments:

Post a Comment