Vauld, a Singapore-headquartered crypto lending and exchange startup, has suspended withdrawals, trading and deposits on its eponymous platform with immediate effect as it navigates “financial challenges,” it said Monday.

The startup — which counts Peter Thiel-backed Valar Ventures, Coinbase Ventures and Pantera Capital among its backers and has raised about $27 million — said it is facing financial challenges amid the market downturn and has seen customer withdrawals of about $198 million since June 12.

Vauld founder and chief executive Darshan Bathija said the startup is exploring restructuring options and has engaged with Kroll for financial advice and Cyril Amarchand Mangaldas and Rajah & Tann for legal advice in India and Singapore,

“We are confident that, with the advice of our financial and legal advisors, we will be able to reach a solution that will best protect the interests of Vauld’s customers and stakeholders,” he wrote in a blog post, adding that the startup will make “specific arrangements” for customer deposits to meet their margin calls.

Vauld enables customers to earn what it claims to be the “industry’s highest interest rates on major cryptocurrencies.” On its website, it says it offers 12.68% annual yields on staking several so-called stablecoins including USDC and BUSD and 6.7% on Bitcoin and Ethereum tokens. The platform also facilitated several other trading services.

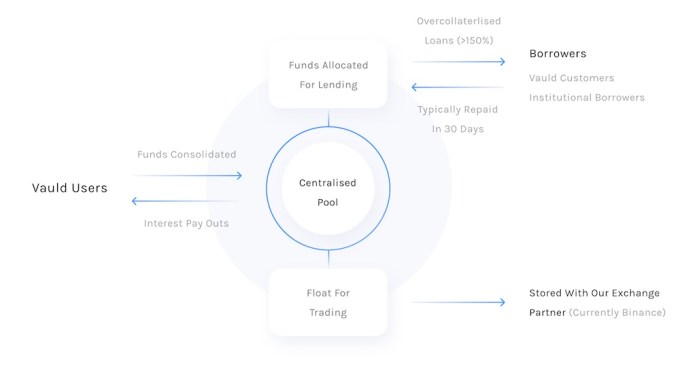

An illustration of how Vauld works. (Image: Vauld)

“We seek the understanding of customers of the Vauld platform that we will not be in a position to process any new or further requests or instructions in this regard. Specific arrangements will be made for customer deposits as may be necessary for certain customers to meet margin calls in connection with collateralised loans,” Bathija wrote today.

The announcement follows Vauld cutting its workforce by 30% two weeks ago.

The move comes as a surprise. On June 16, Bathija had assured Vauld customers that the platform had no exposure to Celsius, another lending startup that is facing increasing financial challenges, and Three Arrows Capital, one of the high-profile crypto hedge funds that filed for a Chapter 15 bankruptcy over the weekend.

“We remain liquid despite market conditions. Over the last few days, all withdrawals were processed as usual and this will continue to be the case in the future,” Bathija wrote earlier.

from TechCrunch https://ift.tt/dNo7bDe

via Tech Geeky Hub

No comments:

Post a Comment