While the ambitions of crypto investors have swelled even faster than the market has in recent months, institutional players have had a mountain of blockchain data to try to make sense of without particularly mature analytics products at their disposal.

Blockchain analytics startup Nansen is building a product for crypto traders and hedge funds to more confidently navigate the world of decentralized finance. Their product analyzes public blockchain information across some 90 million Ethereum wallets to clue users into evolving opportunities.

“Nansen’s high-quality data enables investors to follow where the smart money is moving, where influential investors are taking positions as well as for discovering new projects to invest and perform due diligence,” Nansen CEO Alex Svanevik tells TechCrunch in an email.

The startup just closed a $12 million Series A led by Andreessen Horowitz (a16z), which recently unveiled a whopping $2.2 billion crypto fund designed to bankroll the firm’s crypto land grab. Other investors in the round include Coinbase Ventures, Skyfall Ventures, imToken Ventures, Mechanism Capital and QCP Capital.

Nansen’s primary product is a network of dashboards designed around specific verticals in the crypto space.

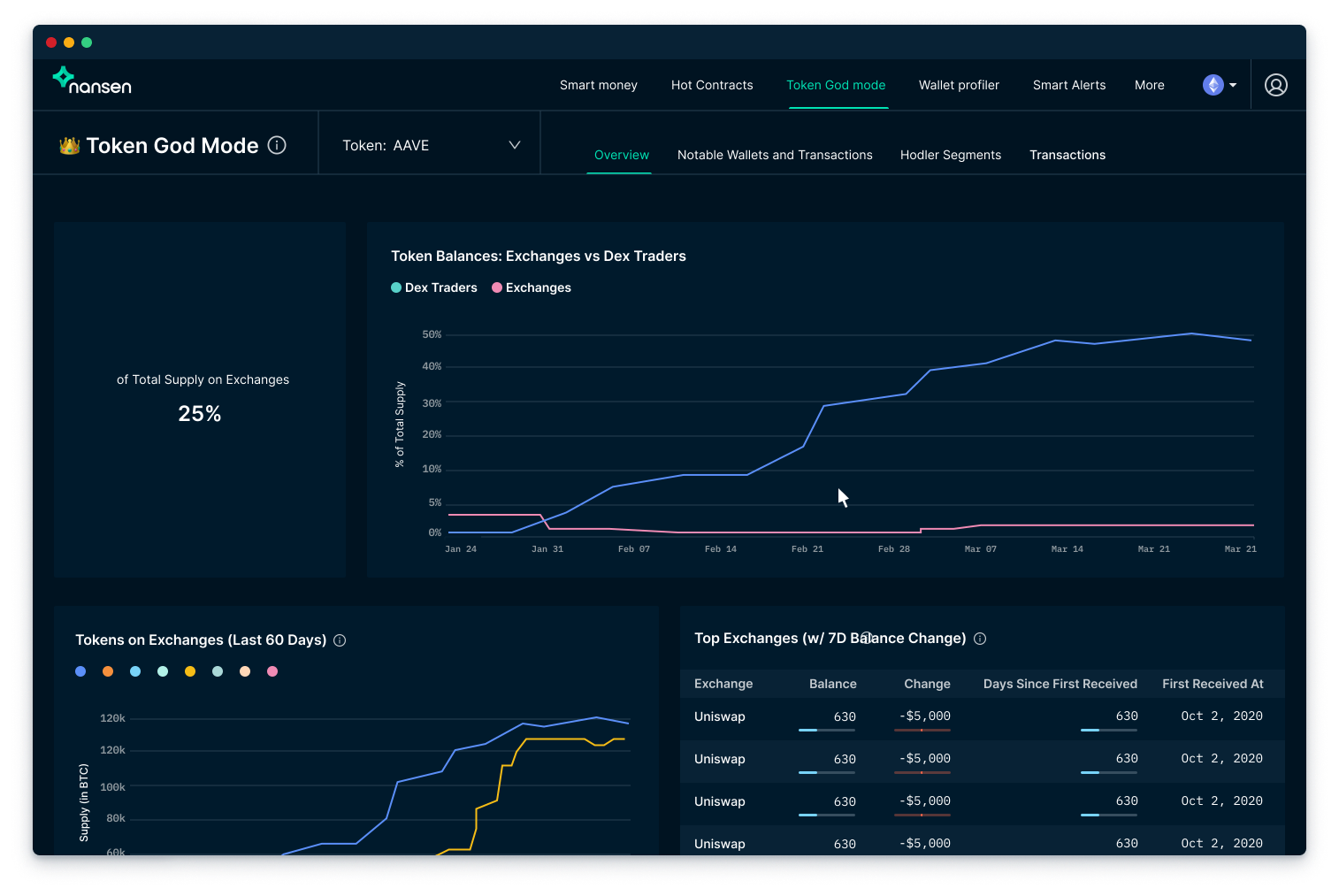

Beyond the very hot DeFi space, Nansen is tapping their labeled database to find investor opportunities in yield farming, liquidity pools, DEX data, and even helping traders scout out particularly hot NFT collections. One of its popular dashboards called “Token God Mode” allows investors to tap into blockchain data on a particular ERC20 token, witnessing movement across exchanges over time as well as notable transactions across individual wallets.

Image Credits: Nansen

As the crypto industry largely aims to bring more retail investors into its fold, Nansen’s pricing showcases an effort to bring in a fairly wide range of customers. The startup sells a $116 per month package designed to help traders tap into real-time analytics across a variety of market indicators, while also shopping a $2,500 per month plan designed to foster a closer relationship with more bespoke support access including weekly calls, exclusive chat groups and vertical-specific information sessions.

The team has been publishing some of its higher-level data publicly on its site, but saves the more granular up-to-the-moment data for its network of paying customers. Some of Nansen’s customers include crypto-centric funds like Polychain, Three Arrows, Pantera, and Defiance Capital.

from TechCrunch https://ift.tt/3drGDfQ

via Tech Geeky Hub

No comments:

Post a Comment