The vast majority of people in India, the world’s second most populous nation, don’t have health insurance coverage. A significant portion of the population that does have coverage get it from their employers.

Plum, a young startup that is making it easier and more affordable for more firms in the nation to provide insurance coverage to their employees, said on Monday it has raised $15.6 million in its Series A funding to accelerate its growth. Tiger Global led the funding round.

Existing investors Sequoia Capital India’s Surge, Tanglin Venture Partners, Incubate Fund, Gemba Capital, also participated in the new round, which brings the one-a-half-year-old startup’s to-date raise to $20.6 million.

Kunal Shah (founder of Cred), Gaurav Munjal, Roman Saini and Hemesh Singh (founders of Unacademy), Lalit Keshre, Harsh Jain and Ishan Bansal (founders of Groww), Ramakant Sharma and Anuj Srivastava (founders of Livspace), and Douglas Feirstein (founder of Hired) also participated in the new round.

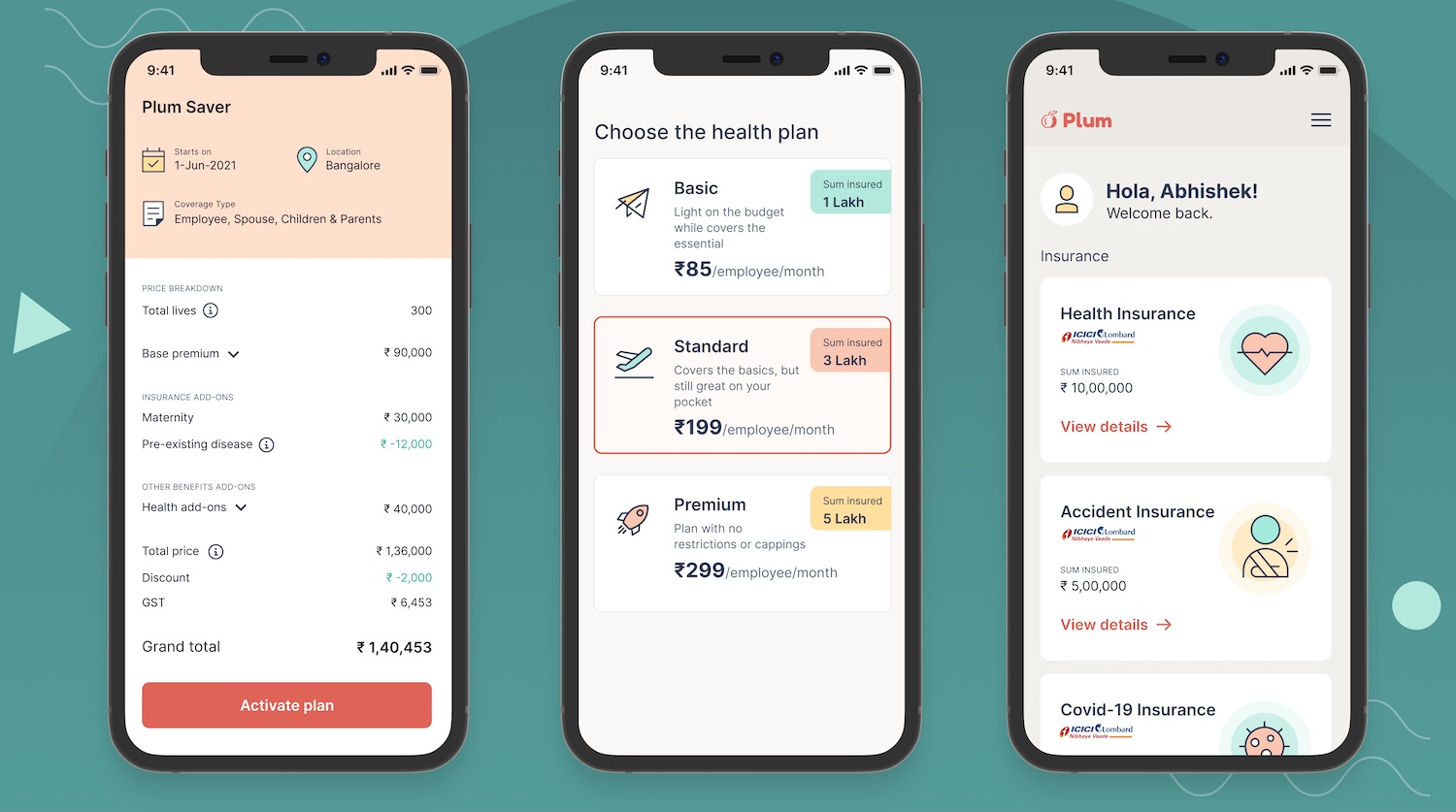

Plum offers health insurance coverage on a B2B2C model. The startup partners with small businesses to provide health insurance coverage to all their employees (and their family members), charging as little as $1 a month for an employee.

The startup has developed the insurance stack from scratch and partnered with insurers to include additional coverage on pre-existing conditions and dental, said Abhishek Poddar, co-founder and chief executive of Plum, in an interview with TechCrunch.

(Like fintech firms, which partner with banks and NBFCs to provide credit to customers, online insurance startups have partnerships with insurers to provide health insurance coverage. Plum maintains partnerships with ICICI Lombard, Care Health, Star Health and New India Assurance.)

Poddar, who has worked at Google and McKinsey, said Plum is making it increasingly affordable and enticing for businesses to choose the startup as their partner. Most insurance firms and online aggregators in India today currently serve consumers. There are very few players that engage with businesses. Even among those that do, they tend to be costlier and not as flexible.

Plum offers its partnered client’s employees the option to top up their health insurance coverage or extend it to additional members of the family. Unlike its competitors that require all the premium to be paid annually, Plum gives its clients the ability to pay each month. And signing up an entire firm for Plum takes less than an hour. (The speed is a key differentiator for Plum. Small businesses have to typically spend months in negotiating with other insurers. Bangalore-based Razorpay has also partnered with Plum to give the fintech startup’s clients a three-click, one-minute option to sign up for insurance coverage.)

The startup plans to deploy the fresh capital to further expand its offerings, making its platform open to smaller businesses with teams as small as seven employees to sign up, said Poddar. The startup plans to cover 10 million people in India with insurance by 2025, and eventually expand to international markets, he said.

India has an under-penetrated insurance market. Within the under-penetrated landscape, digital distribution through web-aggregators today accounts for just 1% of the industry, analysts at Bernstein wrote in a recent report.

“As India’s healthcare insurance industry rapidly expands and transforms, Plum is well positioned to make comprehensive health insurance accessible to millions of Indians. We are excited to partner with Abhishek, Saurabh and the Plum team as they scale their leading tech-enabled platform to employers across the country,” said Scott Shleifer, Partner at Tiger Global, in a statement.

from TechCrunch https://ift.tt/2SFYhVN

via Tech Geeky Hub

No comments:

Post a Comment