Streaming media software maker Plex announced today it has raised a $50 million growth equity round from existing investor Intercap ahead of its planned business expansion into rentals, purchases and subscription content. This is the first financing Plex has taken on since 2014 and is being partly used to purchase shares and options from Plex’s early seed investors and shareholders from prior acquisitions, and to give the company’s earliest employees a bit of liquidity. Of the $50 million raised, $15 million will be put to work as new growth capital.

The company declined to disclose its valuation as a result of the funding — technically Plex’s Series C — but says it resulted in a relatively low dilution for its existing investors who have stayed in, including Kleiner Perkins and Nexstar, for example. Meanwhile, some of its earliest investors were able to get a 10x return or greater on their shares.

As part of the round, Intercap chairman and CEO Jason Chapnik joined the board of directors as chairman, and Intercap president James Merkur also joined the board. Including this financing, Plex has raised more than $60 million.

To date, Plex has been cautious about fundraising because, as Plex CEO Keith Valory says, “we really hadn’t had to.” That is, the company has been profitable on its own.

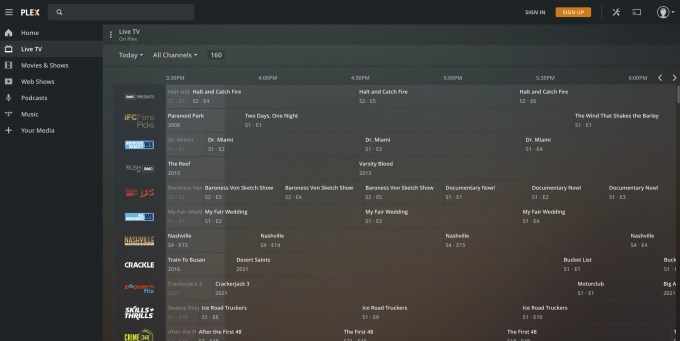

But things have been changing at Plex in recent years. Though it has always catered to the home media enthusiast with its software for organizing movies, TV, music and photos on users’ home networks, Plex more seriously began to go after the larger market of cord cutters with its 2017 launch of a low-cost, DIY streaming TV service. In the years since, it expanded into free, ad-supported streaming and last year took on rivals like ViacomCBS-owned Pluto TV with its own launch of a live TV service, also supported by ads.

Today, Plex now offers more than 20,000 free on-demand movies and shows and over 150 free live TV channels in 193 countries, alongside access to other content, including personal media libraries, streaming music and podcasts.

As it expanded the types of services it offers, it also lowered the barriers to entry for Plex newcomers. Users now no longer have to sign up for an account to access the ad-supported video or live linear streaming service, which impacts Plex’s business model.

Image Credits: Plex

“That is much more tailored towards paid marketing — like getting integrated into the search capabilities for devices like Roku, Fire TV or Vizio, etc. But then, also, using [search engine marketing] and Facebook and other, even on-device paid marketing programs to get people to get in and start watching something,” says Valory. “We found that the kind of paid marketing and customer acquisition costs for that business is really efficient. We’ve been able to get profitable on that marketing investment really, really quickly,” he adds.

That model is what prompted Plex to consider raising capital to grow this aspect of its business and expand in new areas, as well.

That included managing subscription content and offering rentals and purchases — something Plex began to talk about last year as part of its roadmap, saying they could potentially arrive in 2020. But then COVID hit, and though streaming itself grew — particularly ad-supported video in April through June or July — some Plex employees were hit harder than others by the pandemic. And Plex also needed more time to ready the infrastructure involved.

It’s now preparing to launch these efforts this year, perhaps initially with a video rental marketplace or a subscription aggregator. (Plex says it’s not sure which will get out of the gate first because both are being built simultaneously.)

With the subscription play, Plex isn’t looking just at selling subscriptions the way that say, Amazon or Apple do through Prime Video Channels or Apple TV Channels. It’s also considering deep linking technology to get users to their favorite streaming apps, including those from the big-name brands that otherwise wouldn’t want to be a part of someone else’s service. This could position Plex as a competitor to services like Reelgood, which today allows users to track what they’re watching and get recommendations across all their streaming apps, not just within each individual app.

Plex’s video rental (and maybe purchases) marketplace, meanwhile, will be much like any other, offering users a chance to pay for content they couldn’t find a way to stream.

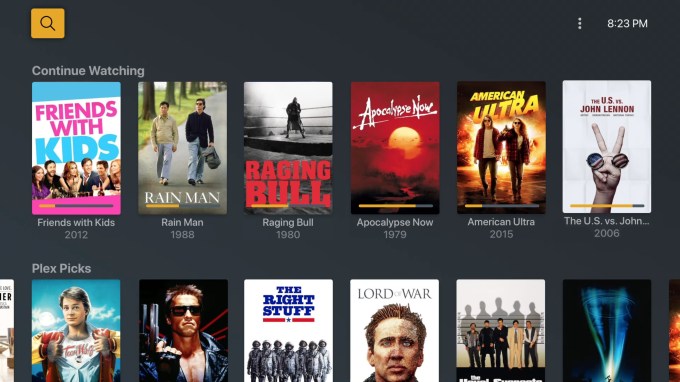

Both ideas fit in with Plex’s larger goal to become a one-stop shop for all your media needs.

“We’ve always had a fairly audacious mission. You shouldn’t have to go to 20 different apps to get the content you care about. You should be able to go to one place and we should be able to do all that for you,” notes Valory.

Image Credits: Plex

To fuel its growth on both this front and for its ad-supported businesses, Plex plans to use the funds to expand its now 100-person team with investments in marketing and monetization teams, as well as on the development side.

“Certainly, there’s still way more work to do in terms of amplifying the efforts on our performance and growth marketing and engagement,” Valory says. “I mean, the business is growing super fast, so we’ve done a pretty good job, to date, of building out the muscles to get new users in the pipeline for the AVOD business. There’s still a ton of work to do there, but a lot of the muscles that we’re building there will help in terms of the top-of-funnel and increasing engagement for the whole product,” he adds.

Intercap, which led Plex’s round, is in it for the long haul — citing in particular how the fragmentation happening now in the streaming landscape could ultimately be good for Plex’s own growth.

“Content providers, creators and consumers are all paying the price for the explosion of so many streaming media services and the industry needs a trusted way for the experience to be as enjoyable as possible,” says Chapnik. “Plex has always been at the forefront of solving new media challenges and we believe they are primed to solve this problem — they are the cable company of the future.”

from TechCrunch https://ift.tt/3uOydW3

via Tech Geeky Hub

No comments:

Post a Comment