Editor’s note: Get this free weekly recap of TechCrunch news that any startup can use by email every Saturday morning (7 a.m. PT). Subscribe here.

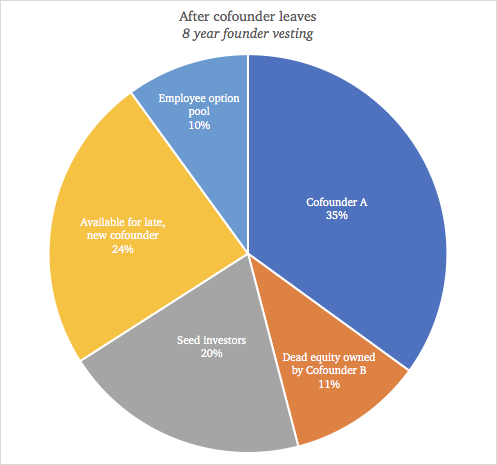

The four-year vesting schedule that the typical startup uses today is a problem waiting to happen. If one founder ends up quitting a year or two before the last cliff, they still own a large share of the cap table through many rounds to come. The departing founder might consider that fair, but the remaining founder(s) are the ones adding on the additional value — and resentment is not the only issue.

“The opportunity cost of dead equity is talent and capital,” Jake Jolis of Matrix Partners explains in a guest post for us this week. “Compensating talent and raising capital are the (only) two things you can use your startup’s equity for, and you need to do both in order for your company to grow large. If you want to build a big business, the road ahead is still long and windy, and you’re going to need every bit of help you can get. If your competitors don’t have dead equity you’re literally competing with a handicap.”

Instead, he argues that founders who are just starting out should consider doubling the vesting schedule to eight years or so. In one example he gives, a founder who leaves after two and a half years on a four-year plan could end up with 22% of the company even after a big new funding round, the creation of an employee stock option pool, and additional shares set aside for a replacement cofounder-level hire. On an eight-year plan, that would be only 11%, and there would be a lot more remaining to entice new cofounders.

The full article is on Extra Crunch, but I’m including more key parts here given the broad value:

Given the risks still ahead of the business, this level of compensation is often much more fair from a value-creation standpoint. With less dead equity on the cap table, the startup is still attractive in the eyes of VCs and well-positioned to attract a strong co-founder replacement to take the company forward. The alternative can cripple the company, and even co-founder B won’t be happy owning a larger percent of zero. While it’s better to do it when you start the company, a co-founder unit can elongate their vesting later on as well. The main requirement is that all the co-founders believe it’s in their best interest and agree to it. Most repeat founders I’ve talked to agree that four years is too short. Personally, if I started another company, I’d pick something like eight. You definitely don’t need to. You might decide four or six is better for your co-founder unit and your company.

One final thought, from my startup cofounder years. The departing cofounder should still want to see the company succeed as big as possible to maximize the value of their own shares. On the steep slope between failure and success in this business, vesting longer is a powerful way to help the company will deliver the most back to them after the hard work of the early days.

Image Credits: FirstMark

Why one successful early-stage VC firm is getting into SPACs now

SPACs are an exciting development for any type of investor, public or private, Amish Jani of FirstMark Capital tells Connie Loizos. Indeed, his firm has historically focused on writing early-stage checks, so at first it is a bit jarring to see the FirstMark Horizon Acquisition SPAC raise $360 million and head out looking for the right unicorn. But he explains it all quite well an extensive interview this week:

TC: Why SPACs right now? Is it fair to say it’s a shortcut to a hot public market, in a time when no one quite knows when the markets could shift?

AJ: There are a couple of different threads that are coming together. I think the first one is the possibility that [SPACs] work, and really well. [Our portfolio company] DraftKings [reverse-merged into a SPAC] and did a [private investment in a public equity deal]; it was a fairly complicated transaction and they used this to go public, and the stock has done incredibly well.

In parallel, [privately held companies] over the last five or six years could raise large sums of capital, and that was pushing out the timeline [to going public] fairly substantially. [Now there are] tens of billions of dollars in value sitting in the private markets and [at the same time] an opportunity to go public and build trust with public shareholders and leverage the early tailwinds of growth.

He goes on to explain why public markets are likely to stay hot for the right SPACs far into the future.

AJ: I think a bit of a misconception is this idea that most investors in the public markets want to be hot money or fast money. There are a lot of investors that are interested in being part of a company’s journey and who’ve been frustrated because they’ve been frozen out of being able to access these companies as they’ve stayed private longer. So our investors are some of are our [limited partners], but the vast majority are long-only funds, alternative investment managers and people who are really excited about technology as a long-term disrupter and want to be aligned with this next generation of iconic companies.

Check out the whole thing on TechCrunch.

SaaS continues to boom with Databricks funding, Segment acquisition

Maybe Segment would have gone public sometime soon, but instead Twilio has scooped it up for $3.2 billion this week. The popular data management tool will now be a part of Twilio’s ever-expanding suite of customer communication products. Perhaps it’s another sign of a consolidation phase taking hold in the sector, after a Pre-Cambrian explosion of SaaS startups over the last decade? Alex Wilhelm dug into the financials of the deal for Extra Crunch and came away thinking that the deal was not too expensive — in fact he thinks Segment may have been able to hold out for a little more, especially considering the multiplication of Twilio’s stock price this year.

Databricks, meanwhile, has evolved from an open-source data analytics platform that struggled to make revenues to a run rate of $350 million. Per an interview that Alex did for EC with chief executive Ali Ghodsi, the factors in this growth included a shift to focus on more proprietary code, big customers and sophisticated features. It’s now aiming for an IPO next year.

And what about that IPO market, which was a bit quieter this week? Alex gives a letter grade to each of the 18 most notable tech companies that have gone public this year, and observes that most them are continuing to stay in positive territory from their initial prices.

Image Credits: Brent Franson for Paystack

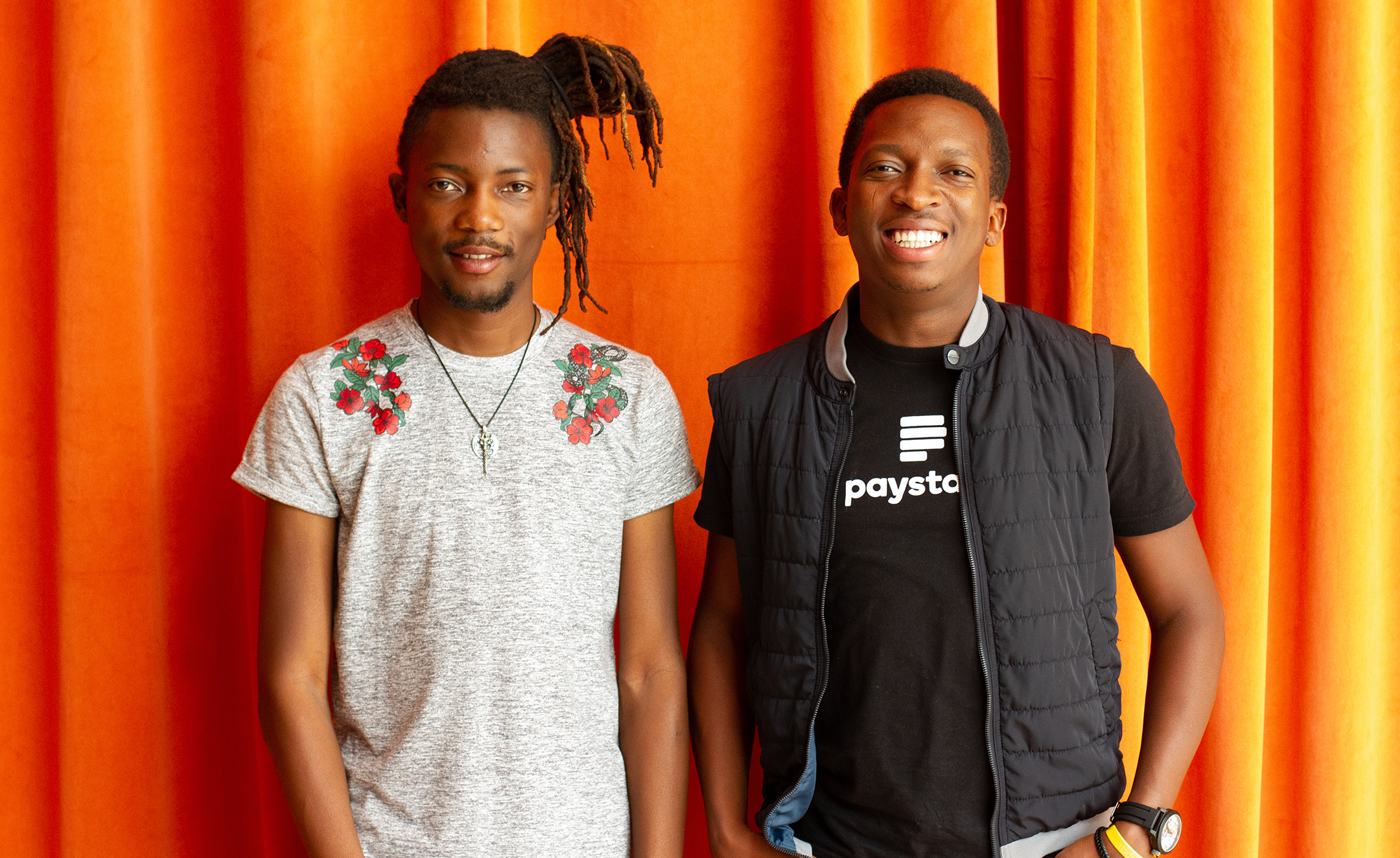

Nigeria startup scene gets watershed exit with Paystack deal

Lagos has been building a strong local startup scene for years, and this week that translated into a win that could mark a new era for the city, country and beyond. Stripe has agreed to acquire payments provider Paystack in a deal that Ingrid Lunden hears was worth more than $200 million. With Stripe’s own aims for a massive IPO, Paystack is poised to produce ongoing returns for the company and its investors, as well as providing Nigeria with a new generation of investors, founders and highly skilled employees who are tightly interlinked with Silicon Valley and other innovation centers.

A startup hub just needs one or two of the right deals to change everything. Readers who were paying attention when Google bought YouTube almost exactly 14 years ago today will remember the ensuing surge in fundings, foundings, acquisitions and overall consumer internet industry activity that helped the Silicon Valley internet scene get back on its feet (and helped this site get on the map, too). Stripe has said it is planning more global expansion that could include additional deals like this, so more cities around the world could be getting their moments this way.

Donau City development area – Vienna, Austria

Vienna startups finding new opportunities during the pandemic

In this week’s European investor survey for Extra Crunch, Mike Butcher checks in on Vienna, Austria, which has been tallying up growth in local startup activity recently. Here’s Eva Ahr of Capital 300, which focuses on Germanic and Central Eastern European investments, regarding about the impact of the pandemic on the local markets:

Telemedicine, online education has been accelerated. We see a shift that otherwise would have taken years, especially in the relatively conservative German-speaking area. As mentioned previously, mental health solutions, hiring and employing remotely are some of the opportunities highlighted by COVID-19. Companies that are heavily exposed are those that have been serving the long tail of companies, small merchants, and local businesses that were closed down or experienced much less traffic in past months and hence are extremely sensitive around their cost base, discontinuing services that are not 110% essential.

Mike is also working on a Lisbon survey and we’d love to hear from any investors focused on the city and Portugal in general.

Around TechCrunch

Discuss the unbundling of early-stage VC with Unusual Ventures’ Sarah Leary & John Vrionis

Across the week

TechCrunch:

If the ad industry is serious about transparency, let’s open-source our SDKs

Brazil’s Black Silicon Valley could be an epicenter of innovation in Latin America

South Korea pushes for AI semiconductors as global demand grows

The need for true equity in equity compensation

Trump’s latest immigration restrictions are bad news for American workers

Extra Crunch:

How COVID-19 and the resulting recession are impacting female founders

Startup founders set up hacker homes to recreate Silicon Valley synergy

Brighteye Ventures’ Alex Latsis talks European edtech funding in 2020

Dear Sophie: I came on a B-1 visa, then COVID-19 happened. How can I stay?

What the iPhone 12 tells us about the state of the smartphone industry in 2020

#EquityPod

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast (now on Twitter!), where we unpack the numbers behind the headlines.

The whole crew was back today, with Natasha and Danny and I gathered to parse over what was really a blast of news. Lots of startups are raising. Lots of VCs are raising. And some unicorns are shooting to go public. It’s a lot to get through, but we’re here to catch you up.

Here’s what we got into:

- A Media Roundup: The Juggernaut raised $2 million in a round that we found to be both cool and timely. The news of a media startup raising money was paired with rumors of an exit for email media darling Morning Brew for a price tag of up to $75 million. Undergirding each story was recent reporting concerning the revenue success that Axios is enjoying. It’s nice to report on some media news that isn’t fresh layoffs.

- A cluster of wellness startups raising capital: If you like to work out your mind and body, it was a good week of news for you. Calm is looking for new funds at a fresh, higher valuation. TechCrunch has coverage here. Coa did raise, adding $3 million to its coffers for mental health group classes. And Playbook put together $9.3 million for its fitness instructor platform.

- VCs raised lots: It’s a hot time for VCs themselves to raise money, with OpenView, Canaan, True Ventures, Lead Edge Capital, First Round and Khosla either closing rounds or announcing new fundraises.

- Also on the VC beat: Terri Burns was made an investing partner at GV.

- Finally, we got into the recent GetAround funding and turnaround story, which segued us into Airbnb’s own recovery. TechCrunch has more here.

And with that, we’re off until Monday morning. Chat soon, and stay safe.

Equity drops every Monday at 7:00 a.m. PDT and Thursday afternoon as fast as we can get it out, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

from TechCrunch https://ift.tt/3dAEzAS

via Tech Geeky Hub

No comments:

Post a Comment